By understanding how President Trump’s influence is shaping events across Western, Asian, Middle Eastern (Arab), and African regions, we can better grasp the phenomenon—The Trump Effect—that I am likening to the Big Bang. Hopefully, this will encourage a more balanced perspective and lead to negotiations rather than a tit-for-tat trade war.

One irrefutable fact is that Trump is rewriting the global trade rulebook, and he is doing so by squelching globalization—a phenomenon that began between the late 18th and early 19th centuries. Placing this into historical context, the Silk Road and the Industrial Revolution—which began in Great Britain following the invention of the steam engine and the mechanical loom—kick started global trade by enabling mass production for markets beyond local demand.

In the modern era, global trade received a significant boost from the establishment of the World Economic Forum (WEF) in 1971, in Davos, Switzerland. Since then, global trade has been guided by the Davos Manifesto, which champions ethical entrepreneurship, responsible governance, and the neutral ideals of Swiss diplomacy—underpinning the spirit of globalization. A formal charter for this vision was adopted in 1973 and renewed in 2020.

History shows that global trade thrives when protected—and falters when it is not. For instance, trade in silk and spices between China and Rome during the first century BC flourished when protected by powerful empires. Once those empires declined, so did the trade routes and their prosperity.

Currently, as President Donald Trump—the head of the present world superpower—adopts a protectionist position, this aligns with his previous actions. Throughout his career, he has frequently employed tariffs as a means of exerting economic influence. As far back as 1988, during an appearance on Oprah Winfrey’s show, Trump—who was then primarily known as a real estate developer—criticized China, alleging that they were taking advantage of the U.S. economy.

Trump is not the only one taking this stance. An old video from 1996 has emerged showing Nancy Pelosi, who was at that time a congresswoman representing California, speaking out against a proposal granting China specific trade privileges. In her argument, she contested tariff breaks for goods coming from China—a position that aligns with what Trump currently supports.

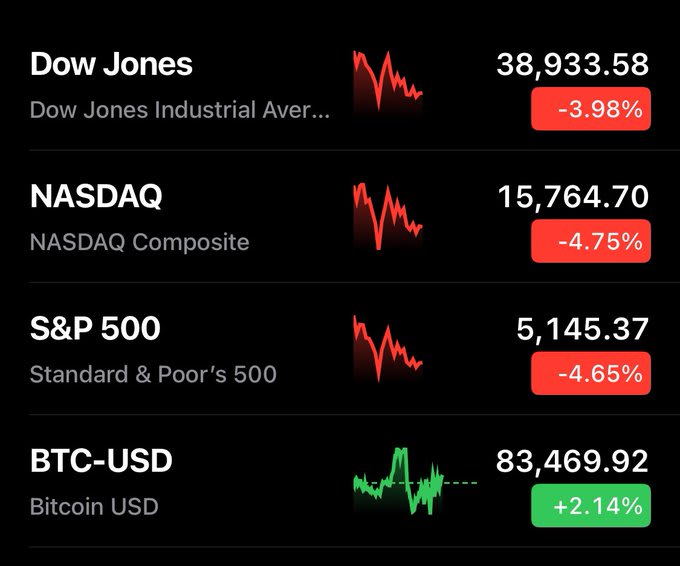

In summary, the use of tariffs as a strategic tool in global trade has bipartisan roots in the US. What has changed is the scale and audacity of the Trump administration’s approach, which has sent shockwaves across the global economic landscape—earning it the moniker of a Big Bang moment in trade history.

Therefore, Trump is essentially mirroring Pelosi's views by now implementing significant tariffs. The key distinction lies in the scope: these increased duties aren’t confined to just China but have been expanded to cover approximately 180 countries, impacting around 60 nations quite substantially.

More intriguing still, recent reports indicate that back in 2019, Vermont Senator Bernie Sanders advocated for using tariffs to combat unfair trading tactics. This concept is now central to President Trump’s current global tariff conflict, putting the international community on high alert.

Specialists knowledgeable about the historical background and present usage of tariffs disclose that approximately $400 billion worth of American products faced tariffs during Trump’s initial term. For his ongoing second tenure, estimates indicate that as much as $1 trillion worth of merchandise could be subject to U.S. trade tariffs.

Based on economist projections, around $3.3 billion worth of goods are imported into the United States each year.

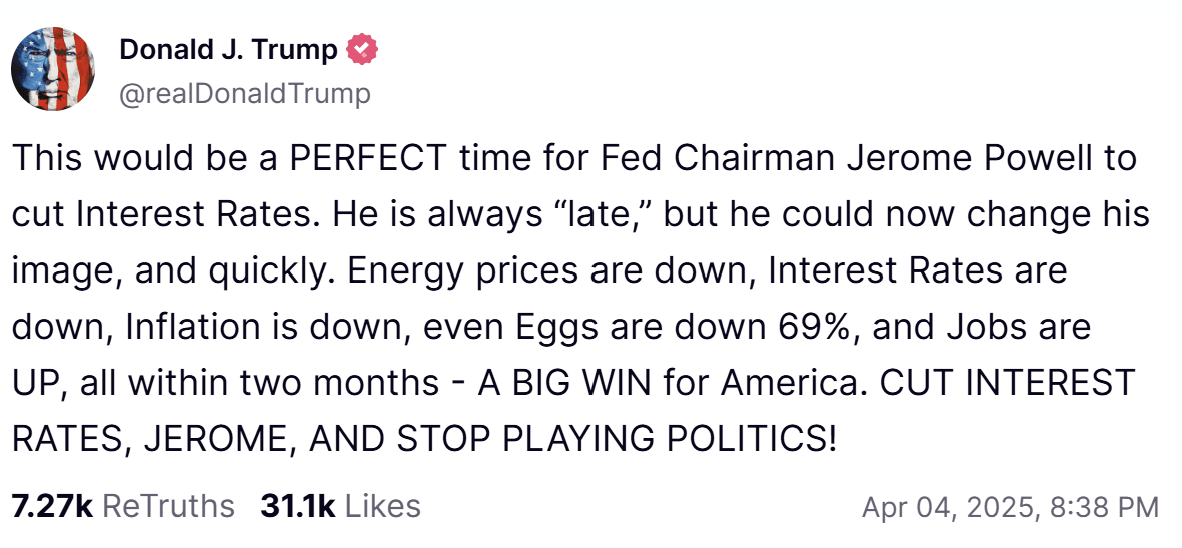

President Trump believes that his policy of imposing higher tariffs will lead to greater prosperity for the United States by fostering more domestic manufacturing. This growth is expected to provide more job opportunities for working-class Americans as well. A major aim is also to achieve equitable trade practices between the U.S. and its international trading partners, who Trump claims have been gaining unfair advantages at the cost of American interests.

In the end, President Trump intends to utilize the revenue generated from these elevated tariffs to aid in narrowing the $36 trillion budget deficit confronting the globe's biggest and strongest economy.

Given these circumstances, Mr. Peter Navarro, an advisor to President Trump on trade matters, contends that substantial tariffs could yield more than $6 trillion for the United States in the near future.

In all of this, my main concern and interest is in how Africa can benefit from the reimagining of the global socioeconomic ecosystem, as President Trump upends the old world order.

Given the 14% tariff introduced by the United States on Nigerian products and the 10% levy applied broadly across most of Africa’s 54 countries, Nigeria faces significant challenges with its exports to America—which were worth roughly $5 to $6 billion last year (oil and gas comprised more than 90%, while non-oil/gas items constituted less than 10%). These tariffs pose a substantial risk to their trade relationship.

Even within non-oil/gas exports, the majority consists of raw materials like urea/fertilizers, ammonia, floral products, and cashews, accounting for approximately 8%.

It is disheartening that value-added or processed exports from Nigeria to the U.S. amount to just 2%, which is remarkably low.

Even though this number is small, the introduction of a 14% duty on Nigerian products—even with the trade surplus being advantageous to the U.S.—ought to act as an alarm for Nigeria and, by extension, all of Africa. It should prompt them to start enhancing the value of their exported items. For non-oil exports, which encounter a 10% tariff, to remain competitive in the American marketplace, they will have to advance along the value chain.

Nigeria's export prominence lies in raw materials, showcasing the nation's persistent function as a provider of these resources to developed countries across Europe, North America, and Asia. Of all six continents, merely South America and the Arab region haven’t completely utilized Africa both as a primary source for raw materials and an outlet for manufactured goods. Consequently, Africa has often been cast in the role of the aggrieved party, having shouldered unfavorable conditions. It thus needs to undertake deliberate actions with clear strategies aimed at reshaping this adverse storyline.

The Trump tariffs evoke thoughts of deglobalization as international trade and investments among nations diminish. However, this global tariff conflict presents Africa with a chance to redefine itself globally through unified action regarding intra-African commerce. It allows the continent to establish trading relationships within the Global South, West, and East under conditions set by Africans rather than adhering to frameworks like those established during the Berlin Conference in 1884-1885, where European powers carved up Africa without including representatives from the continent whose resources they divided.

• Magnus Onyibe, an entrepreneur, public policy analyst, author, advocate for democracy, and development strategist who graduated from the Fletcher School of Law and Diplomacy at Tufts University in Massachusetts, USA, and previously served as a commissioner in the Delta State government, contributed this article from Lagos, Nigeria.

If you wish to proceed with this discussion or explore further topics, kindly head over to www.magnum.ng .

Provided by SyndiGate Media Inc. Syndigate.info ). Read more

Read more