On April 4, as stock markets declined for the consecutive day, U.S. Federal Reserve Chairman Jerome Powell said The Trump administration’s “reciprocal tariffs” might considerably impact the economy, possibly resulting in "increased inflation and reduced growth."

At a conference on April 4, Powell adopted a careful stance and warned that tariffs might cause inflation to surge "in the upcoming quarters," which would complicate the Federal Reserve’s aim of achieving a 2% inflation rate. This comes only months after indications suggested potential interest rate reductions were expected for a smooth economic transition. As Powell stated,

Although tariffs are very likely to cause a short-term increase in inflation, it is also plausible that these effects might last for a longer period.

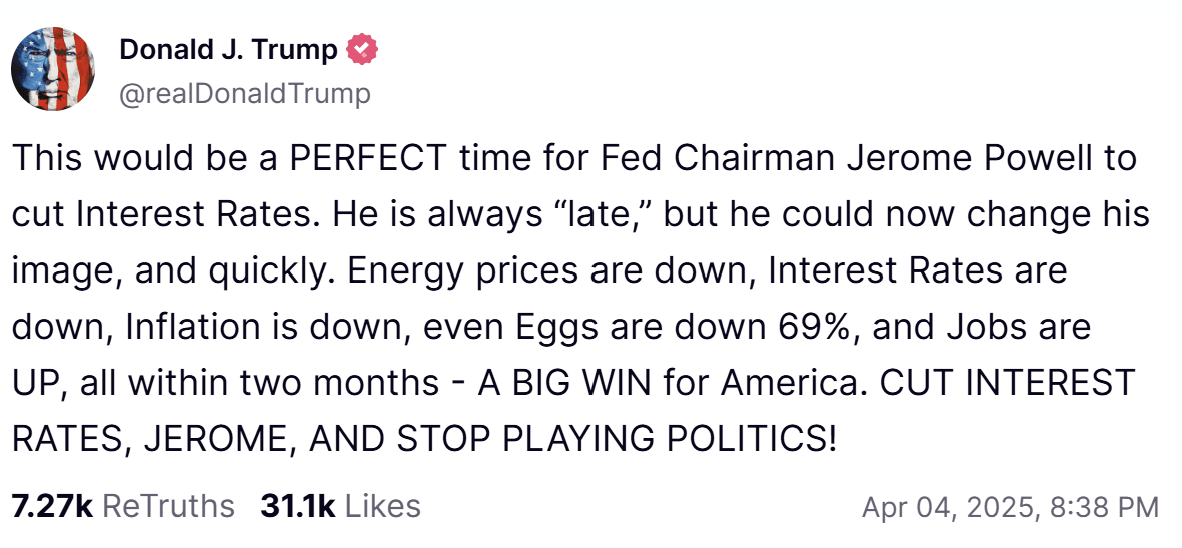

Just moments before Powell gave his speech, US President Donald Trump was present. called posted on Truth Social urging the Fed chair to "LOWER INTEREST RATES," criticizing Powell for always being "too slow."

At present, the Federal Reserve has a crucial decision to make: whether to halt further decreases in interest rates for the remainder of the year or to swiftly implement additional cuts should the economy exhibit indications of deterioration. Despite the acknowledgment from Fed officials that the current economic situation is favorable, Powell indicated that this might not remain the case.

It's too early to determine the suitable course for monetary policy.

On April 4, the unemployment rate climbed to 4.2% in March from 4.1% in February; however, conversely, non-farm payrolls for March surged by an impressive 228,000 jobs, surpassing projections and bolstering evidence of economic resilience. Additionally, the Consumer Price Index (CPI) saw a rise of 2.8% year-over-year in March, with more recent figures scheduled for release on April 10.

These numbers underscore a robust job market yet persistent worries over inflation, which echoes Powell’s caution regarding possible effects of tariffs.

Related: Bitcoin supporters rally at $80K resistance as 'World War 3 of trade wars' decimates US stock market

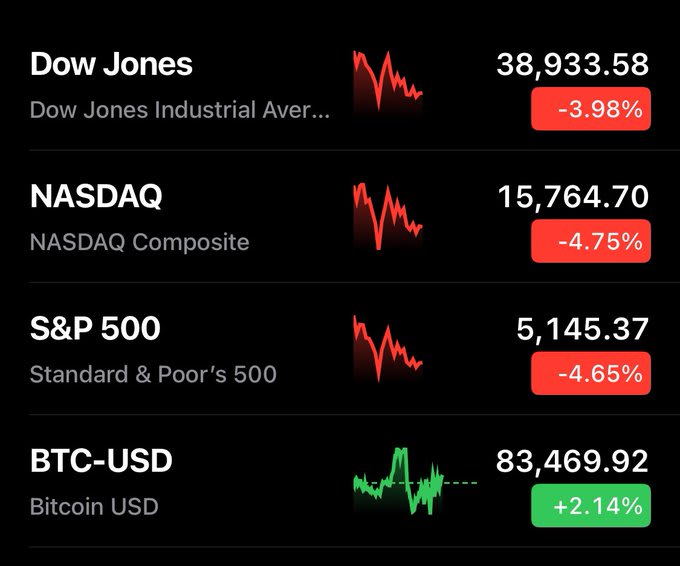

Powell’s warning about increasing inflation and decelerating economic growth occurred on the same day that the Dow plummeted by 2,200 points and experienced a 10% decline over two days in the S&P 500. This information comes from X-based market resource 'Watcher Guru'. announced that,

Today, the U.S. stock market saw a loss of $3.25 trillion, whereas the cryptocurrency market gained an additional $5.4 billion.

Bitcoin may experience additional fluctuations.

Many investors expect that in the near future, Bitcoin will (BTC) might witness an increase in price fluctuations. Powell’s comments regarding tariffs causing "increased inflation" and potentially "greater unemployment" could unsettle conventional market participants, leading them to shift towards Bitcoin as a safer haven.

Actually, experts have noted that the BTC price seems to be "diverging" from the recent decline in stock markets. Despite Bitcoin reaching a 9-day peak on April 2 prior to President Trump unveiling his "reciprocal tariffs" on what was termed "Liberation Day," the price dropped significantly after these tariffs were announced during a White House briefing.

Following that, Bitcoin has consistently remained above the $82,000 mark. When US equity markets plummeted on April 4th, BTC surged to $84,720, showcasing price behavior that deviates from typical patterns.

The independent market analyst Cory Bates shared the aforementioned chart. said ,

Bitcoin is becoming independent right before our eyes.

As China responds with 34% tariffs on U.S. products and President Trump urges Powell to reduce interest rates, increased market instability might drive up Bitcoin's value as a safeguard against economic unpredictability.

In 2018, during the U.S.-China trade conflict, the price of Bitcoin did not witness an overall gain throughout the year. Nevertheless, it showed significant fluctuation and saw a surge of around 15% as tensions heightened in mid-2018. This was triggered by the imposition of tariffs on Chinese products by the U.S. in July, which led to subsequent counteractions from China.

Connected: Bitcoin sentiment has dropped to its lowest point in 2023; however, a 'risk on' climate might arise to ignite aBTC price surge.

The content of this article neither offers nor suggests financial investments or strategies. Any form of monetary investment carries risks, thus viewers should perform independent investigations before reaching decisions.