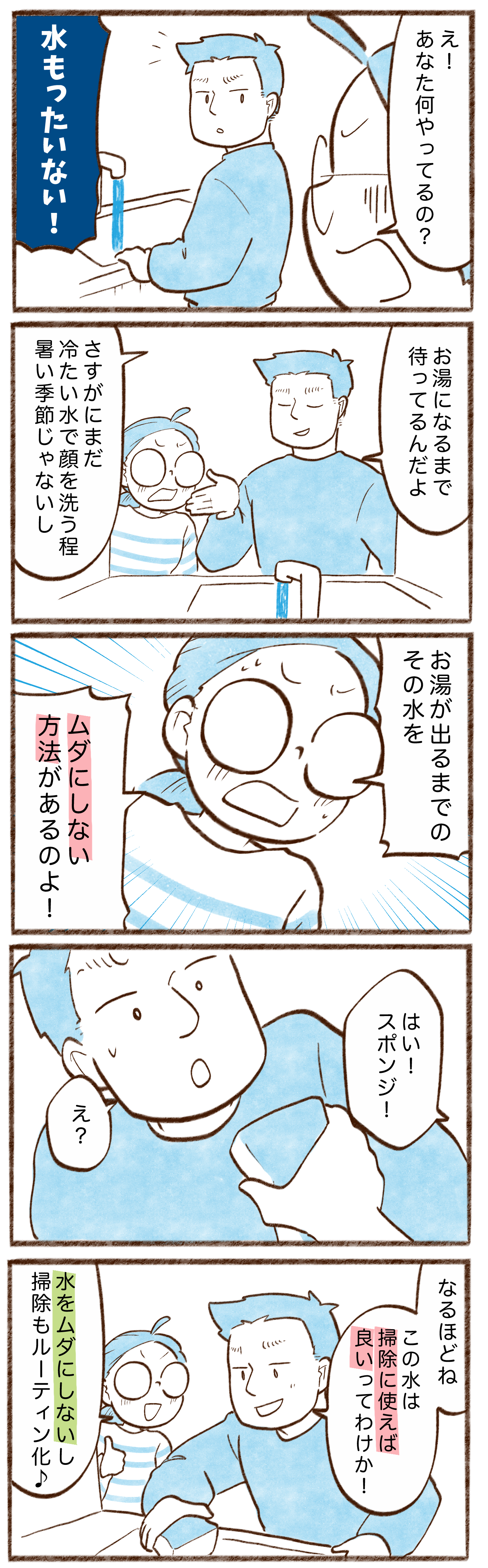

A junior banking employee has received praise for adopting a 'save more' mindset amid Australia's increasing costs. cost of living crisis.

Based in Sydney, Aftab Bismi, who is 30 years old, specializes in data solutions at Suncorp Group and has offered his key suggestions for achieving financial agility in 2025.

Mr. Bismi said he drives a 20-year-old Toyota since purchasing a new vehicle would deplete his total savings of $20,000.

'The simplest solution is to figure out how to cease spending so much money,' he said. A property investment firm located on Coposit Street TikTok video on Monday.

I allocate only a small sum of money, and when I do spend more, it’s with a specific objective in mind.

For instance, I would be okay with splurging on a dinner if those involved could potentially offer something beneficial to me in the future.

Mr. Bismi mentioned that this would encompass friends, possible business collaborators, or individuals with whom he could exchange concepts.

The youthful data specialist was inundated with compliments in the remarks section following the video, being referred to as 'articulate' and a 'clever fellow.'

One user commented, 'I want to learn more from this person!'

'I wish I had that knowledge when I was 30... great going, mate.. wish you all the success,' another wrote.

The young data expert also shared his 'philosophy' when it comes to regulating his spending: only choosing one or two things to invest in.

'I would always invest my money into learning experiences with experts because they're really difficult to come by,' he said.

Mr Bismi said he first experienced this when he was 14-years-old and signed up for a camp with an ex-Los Angeles Lakers player.

"That camp is about three times more expensive than regular camps. I’m learning from someone who has successfully utilized it and found out how they achieved that," he explained.

Mr Bismi disclosed to Daily Mail Australia how he allocates and avoids investing his funds in various areas of his everyday activities.

He has discontinued certain streaming subscriptions, stays away from purchasing new gadgets, and never dines out or orders takeout alone: "Moreover, dining at restaurants does not provide sufficient protein."

To avoid making impulsive purchases, he waits until the following day before finalizing his online orders. Additionally, he only treats himself to coffee during work sessions or when out with friends for leisure activities.

What does he choose to spend his money on?

Mr. Bismi mentioned that he enjoys spending money on perfumes and presents.

"People recall that you're the person with the pleasant aroma... [and] folks tend to offer better presents and hold onto those memories because of it," he stated.

Read more