Donald Trump

has retreated in his global trade battle, with the US president being the key figure.

announced a 90-day period

in which his so-called “reciprocal

tariffs

will be reduced to 10 percent for most countries.

On Truth Social, Mr. Trump issued a vaguely phrased statement where he commended 75 nations for not responding with retaliation and instead attempting negotiations.

Washington

He stated that he had "authorized a 90-day halt, along with a significantly reduced reciprocal tariff over this timeframe, set at 10 percent, taking effect right away."

Simultaneously, the US president

intensified his trade war

with

China

By imposing instant new tariffs of 125 percent, following Beijing’s move to enforce 84 percent counteractive duties.

Mr. Trump stated that he had conceded in other instances because people were becoming "excited" and "somewhat fearful".

Although a Whitehall source stated that the 90-day halt demonstrated "level-headedness can be rewarding," it is believed that Sir Keir Starmer’s administration does not anticipate any imminent alterations to the UK’s present 10 percent tariff.

Wall Street stocks

rose as Mr Trump relaxed his position

, where the technology-focused Nasdaq finished 12.1 percent higher, and the broader S&P 500 index rose by 9.5 percent.

Key points

-

Trump declares 90-day suspension of certain tariffs – yet imposes 125 percent duty on China

-

Beijing plans to implement extra duties of 84 percent on products from the U.S.

-

UK government bond yields reached a 27-year peak following turbulence in the U.S. bond market.

-

The EU Commission approves initial retaliatory measures against Trump's tariffs.

-

Trump's worldwide tariffs go into effect

View: Trump states he will rely on 'instinct' to decide which companies might get tariff exemptions

23:46

,

Andy Gregory

Donald Trump told reporters earlier that he would consider tariff exemptions for some companies hit particularly hard by the stock market chaos of the past weekcaused by his tariffs.

When asked whether he would decide which companies should receive exemptions, he responded: "It's mostly just gut feeling. You barely even need a pencil and paper for this. I believe it comes down to intuition rather than anything else."

Which UK Cities May Be Most Affected by Trump’s Tariffs? A Mapping Analysis

23:33

,

Andy Gregory

US tariffs are set to cause an “uneven storm” across the UK with Coventry expected to be the worst affected, a think tank has warned.

The West Midlands, known as the hub for British automobile production, along with Wales, a key player in British steel output, are expected to bear the major burden of the economic effects triggered by Donald Trump’s intensifying trade conflict. This conclusion comes from a study conducted by Centre for Cities.

My colleague

Rebecca Whittaker

reports:

Charted: Which UK Cities May Be Most Affected by Trump’s Tariffs?

Complete report: Trump significantly shifts stance on tariffs with 90-day suspension, concurrently increasing levies on China to 125%

22:55

,

Andy Gregory

Donald Trump changed course again on Wednesday and announced a 90-day pause of his so-called “reciprocal” tariffs while hiking other duties on China to 125 percent.

Following multiple days of significant declines on the stock market, the U.S. president made this decision. According to a post on Truth Social, Trump stated that he changed course because White House officials claim numerous countries abroad are trying to renegotiate trade policies with the United States instead of imposing their own tariffs.

On Wednesday afternoon, he stated that his choice was prompted by several days of market turmoil and widespread impacts on different parts of the economy. These issues had been persistently attempts by Trump and other White House officials to calm down but without success.

I believed that some individuals were overstepping their bounds," Mr. Trump stated to journalists during a White House gathering with NASCAR drivers on Wednesday afternoon. "They became overly excited, you understand, somewhat agitated and fearful." He added, "I have rescinded it. This will only be for a brief duration.

John Bowden

and

Andrew Feinberg

possess the complete report, originating from Washington DC:

Trump backtracks on tariffs with 90-day pause while hiking duties on China to 125%

The UK and India have reportedly reached an agreement on 90 percent of the free trade deal.

22:33

,

Andy Gregory

The UK and India have reached an accord on approximately 90 percent of their free trade deal, according to reports from a meeting where businesses were briefed by negotiators from the UK’s Department for Business and Trade on Tuesday.

According to The Guardian, citing an official from the government, the controversial topic of mobility – concerning work visas for Indian laborers – has mostly been settled. They added, "We have almost reached our goal; this is the closest we've ever come. However, discussions among politicians can be double-edged."

On Tuesday's conference call, businesses were informed that certain unresolved matters pertained to whiskey and automobiles, as reported by the newspaper—the two sectors of the UK economy most vulnerable to US tariffs.

Goldman Sachs has reduced its prediction, stating that the likelihood of a U.S. recession is currently 45%.

22:10

,

Andy Gregory

Goldman Sachs has reduced its likelihood estimate for a U.S. recession from 65 percent to 45 percent following President Donald Trump’s declaration of a 90-day truce. The investment firm noted that the remaining tariffs would probably lead to an approximate 15 percent rise in total tariff rates.

Experts indicated that the abrupt surge in Wall Street stock values might not fully reverse the harm caused by Mr. Trump’s announced "Liberation Day" tariffs.

Studies have revealed a decrease in both corporate expenditures and consumer spending because of concerns over tariff effects, with a Reuters/Ipsos poll indicating that seven out of ten Americans anticipate price hikes in the coming months.

A White House official states that US tariffs on Mexico and Canada will not be impacted by the 90-day delay.

21:58

,

Andy Gregory

A White House official stated that the U.S. tariffs imposed on imports from Mexico and Canada won’t be influenced by the 90-day delay mentioned by President Donald Trump.

The 25% tariff imposed by Washington on goods imported from Mexico and Canada that do not fall under the USMCA trade agreement continues to apply, according to an official. Additionally, they noted that energy products and potash from both nations will still face a 10% tariff.

Most of the products coming from Mexico and Canada, which fall under the trade deal, have not been subject to the broad tariffs imposed by the United States.

A Fox commentator claims that Trump had to yield on tariffs due to a bond selling spree in Japan.

21:38

,

Andy Gregory

On the usually pro-Trump Fox Business network, journalist Charlie Gasparino unequivocally stated that President Trump "yielded" in his international tariff dispute due to uncertainties within the U.S. bond market—this situation also sparking discussions about potential intervention from the U.S. Federal Reserve.

Mr. Gasparino stated: "Let's make it crystal clear what transpired, who backed down here, and why... It was the White House that gave in, according to all my information and sources. The rationale behind this is due to the bond market and the events from last night."

On social media, he wrote: "Leading financial experts suggest it was Japan, rather than China, that sold off bonds yesterday, disrupting the bond market and compelling Trump to halt his actions."

Wall Street finishes higher following significant increases amid easing of Trump's tariffs.

21:12

,

Andy Gregory

Following Donald Trump’s announcement, Wall Street received a temporary relief, with the S&P 500 finishing 9.5 percent higher on Wednesday. The Nasdaq climbed by 12.1 percent, and the Dow Jones saw an increase of 7.8 percent during the day’s trading session.

Nonetheless, the S&P 500 is still 3.7 percent below where it stood before Mr. Trump announced "Liberation Day" last week; meanwhile, the Nasdaq has dropped by 2.7 percent, and the Dow Jones has fallen by 3.8 percent.

View: Trump states 'no other president would have taken the actions I took'

20:54

,

Andy Gregory

Trump says ‘people were getting a little bit afraid’

20:50

,

Andy Gregory

When asked about pausing his tariffs, despite earlier advising the market to "stay calm," Donald Trump explained to journalists, "I believed some individuals were getting overly excited."

They started becoming quite excited...a little bit scared.

When asked about potentially providing relief to bigger corporations that have suffered significantly due to the recent market downturn, the U.S. President responded, "We will examine this; some businesses have faced tough times, and certain types based on their industry have taken a heavier blow."

When asked about identifying which businesses suffered the most, Mr. Trump replied, "I'll just go with my gut."

The bond market is currently wonderful, according to Trump.

20:45

,

Andy Gregory

Donald Trump stated that the bond market rebounded effectively following investors' unease regarding his tariff policies.

On Wednesday morning, experts cautioned that the US Federal Reserve might need to step in to stabilize the bond market following a significant increase in US Treasury yields during the night, indicating that U.S. assets were briefly losing their status as a safe haven.

The US 10-year Treasury yield reached a seven-week peak at almost 4.5%, though it has since dropped back to 4.34%.

The bond market right now looks great," Mr. Trump stated to reporters following a successful $39 billion auction that alleviated worries as it matched market predictions, with yields set at 4.435 percent—higher than initially expected but still indicating strong interest from investors.

The government source states that staying cool and composed is rewarded.

20:27

,

Jane Dalton

Government officials stated that Mr. Trump’s choice demonstrated “remaining cool and calm can indeed be rewarding.”

One stated: "This is how the Prime Minister conducts business and it's the correct method. He has been advocating for this in every call he made this week and will keep doing so."

We will continue talks with the U.S., states Downing Street

20:13

,

Jane Dalton

The government stated that they would keep communicating with the US administration.

A representative from No10 stated: "Engaging in a trade war serves no one's purpose. Our aim is to avoid any imposition of tariffs altogether. Therefore, with an eye on employment and economic well-being throughout the UK, we will steadfastly and rationally persist in negotiating in the best interest of Britain."

U.S. stock markets surge to all-time high increases

20:09

,

Jane Dalton

Stock markets reach unprecedented increases following Trump's announcement of tariff plans.

UK agreement insufficient, vows Starmer

20:07

,

Jane Dalton

Sir Keir Starmer has cautioned that reaching an economic agreement with the US or obtaining reduced American tariff levels for the UK would fall short of what is needed for Britain.

Prior to Donald Trump suspending or lowering most of his tariffs, the Prime Minister admitted uncertainty about whether the 10% import duty on British products would persist indefinitely. He also stated that the government needs to “ramp up” efforts to adjust to an increasingly dynamic global landscape.

German successor leader claims united European strategy proves successful.

19:54

,

Jane Dalton

Friedrich Merz, who is expected to become Germany’s next chancellor, stated that U.S. President Donald Trump’s decision to suspend tariffs for 90 days indicates that a cohesive European strategy regarding trade has been beneficial. He advocated for eliminating all tariffs between the U.S. and the EU as part of this effort.

"We Europeans are committed to defending ourselves, and this instance demonstrates that solidarity makes us strongest," he said during the TV program RTL Direkt.

He mentioned, 'Let’s establish a 0% tariff rate on transatlantic trade, which would resolve the issue,'.

U.S. stock markets surge close to record highs following Trump's announcement to halt most of his tariff plans.

19:36

,

Andy Gregory

The US stock market has surged close to record highs following Donald Trump’s announcement of a halt on most of his extensive global tariff measures.

You can refresh our breaking report below for more details, and we’ll be bringing you more live updates here on the blog:

Stock markets reach unprecedented increases following Trump’s announcement of tariff plans.

This is Trump's Liz Truss moment, according to the Liberal Democrats.

19:26

,

Andy Gregory

In response to the news that Donald Trump has temporarily halted increased tariffs against most nations for 90 days, Liberal Democrat leader Ed Davey commented, "This is Donald Trump’s Liz Truss moment."

He has been pushed into an awkward reversal. Now we must encourage him to take it even further by eliminating his leftover impulsive tariffs. This requires forming an economic alliance among like-minded countries and joining forces with our partners.

US Treasury Secretary says markets 'misunderstood' Trump's tariff plan.

19:18

,

Andy Gregory

US Treasury Secretary Scott Bessent has stated that the markets "failed to grasp" Donald Trump's tariff strategy.

"The market misinterpreted these as peak values. These figures should be considered by the nations when they approach us with requests to reduce their tariffs and eliminate non-tariff barriers," he stated to journalists at the White House.

He said Mr Trump “created maximum negotiating leverage for himself” and the Chinese have “shown themselves to the world as the bad actors”.

U.S. Treasury Secretary refutes claims of a 90-day halt amid financial market instability

19:11

,

Andy Gregory

When asked if the 90-day halt on "reciprocal tariffs" was linked to the turmoil in financial markets, U.S. Treasury Secretary Scott Bessent responded to journalists at the White House, saying, "No. The reason for this delay is the significant increase in inbound inquiries—we've received communications from over 75 nations, and following today, I expect even greater interest."

It appears this is primarily a matter of process. Every solution for this will need to be custom-made, which requires considerable time, and since President Trump wishes to be directly engaged—this explains the decision for the 90-day extension.

The WTO indicates that commerce between the U.S. and China might decrease by up to 80%.

18:57

,

Andy Gregory

The World Trade Organization has projected that Donald Trump’s trade conflict could reduce merchandise trade between the U.S. and China by up to 80 percent.

"This back-and-forth strategy between the planet's two biggest economic powerhouses, which collectively make up about 3 percent of worldwide commerce, has broader ramifications that might significantly harm the global economic forecast," it stated.

Splitting the worldwide economy into these two blocks might cause a long-term decrease in global real GDP of almost 7 percent, the announcement further noted.

The initial assessment was released when Mr. Trump increased tariffs on goods coming from China, though he temporarily held off on implementing additional ones for a period of 90 days.

Wall Street surges following Trump’s announcement of a 90-day truce on tariffs

18:51

,

Andy Gregory

The primary stock market indices on Wall Street surged following Donald Trump's announcement that he had approved a 90-day suspension of certain tariffs, which would take effect right away.

The Dow Jones Industrial Average has climbed 6.2 percent in today’s trading session, the S&P 500 has advanced 6.9 percent, and the Nasdaq Composite has surged by 8.6 percent.

Trump announces 90-day pause on some tariffs – but hits China with 125 per cent levy

18:35

,

Andy Gregory

Donald Trump has declared that he will promptly increase tariffs on Chinese products to 125 percent and seemingly proposed a 90-day suspension of tariffs for 75 countries that haven’t reciprocated and attempted negotiations with the U.S.

Regarding these countries, Mr. Trump stated—in a vaguely phrased announcement—that he had "approved a 90-day HALT, with a significantly reduced Reciprocal Tax during this timeframe at 10%, taking effect right away."

Posting on Truth Social, he criticized China and stated, "Eventually, ideally soon, China will come to understand that the era of exploiting the U.S. and other nations is neither viable nor tolerable anymore."

However, there is some positive news for Washington's partners; the US president further stated: "On the contrary, considering that over 75 countries have reached out to representatives from the United States, such as those from the Department of Commerce, the Department of Treasury, and the Office of the United States Trade Representative (USTR), to discuss potential solutions regarding trade issues like barriers, tariffs, currency manipulation, and non-monetary tariffs—without retaliating against the United States despite my firm recommendation—I am authorizing a 90-day HALT on certain measures with a significantly reduced reciprocal tariff set at just 10%. This will be implemented right away."

Analysis | Trump crafted his own world. Now we're all trapped within it.

18:26

,

Andy Gregory

"My fellow Americans, today marks Liberation Day," declared Donald Trump at the White House Rose Garden, coining a phrase as he announced an extensive new set of tariffs targeting all U.S. trade partners.

The day will “forever be remembered as the day American industry was reborn, the day America’s destiny was reclaimed, and the day that we began to make America wealthy again,” the president said.

On Wednesday, a grand announcement was made despite warnings from numerous experts who predicted "disastrous" consequences for American consumers due to these taxes. The very next day following " Liberation Day," global stock markets crashed, prompting world leaders to pledge retaliation.

During his inauguration speech, the president used the phrase "like never before" five times, and the tariff proposal is merely the most recent instance showcasing his knack for crafting an alternative interpretation of events.

"We truly haven't witnessed anything akin to this," Professor Chapman Rackaway from Radford University stated in an interview as a political science specialist.

The Independent

He described this degree of reality manipulation as "unequaled" in contemporary U.S. history.

Check out this analysis article by our US-based journalist for further details.

Kelly Rissman

:

Trump created his own reality. Now we’re all stuck in it

Watch: JPMorgan head anticipates a downturn following Trump's tariff moves

17:59

,

Andy Gregory

Selectively editing a quote from Jamie Dimon, Donald Trump made it appear that the JPMorgan Chase chair had recently praised his escalating trade war in an interview with Fox News,

my colleague

Justin Baragona

reports from New York

.

Shortly after the interview, Mr. Trump posted on Truth Social stating, "Adjusting trade policies and tariffs is beneficial!" This comment followed an appearance by Jamie Dimon, Chairman & CEO of JPMorgan Chase, on the Maria Bartiromo show.

Actually, though, Dimon cautioned that a downturn seemed quite possible because of Trump’s extensive tariffs, and he anticipated that loandefaults would increase as the economy slows down.

Check out a segment from the interview below:

UK 30-year government bond yields ended at 5.6%, following their peak since 1998.

17:36

,

Andy Gregory

The expense of extended loans has increased for the UK government following a significant rise in British 30-year bond yields, which reached their peak level since 1998 on Wednesday at 5.61 percent, exceeding an earlier 27-year record from January.

When London's financial markets wrapped up for the day, the yield stood at 5.6 percent. This shift came after substantial increases in 30-year U.S. Treasury yields during the night, indicating that U.S. assets might have briefly lost their haven appeal amid ongoing turmoil triggered by President Donald Trump’s tariff policies affecting worldwide markets, according to market experts.

George Saravelos, who leads foreign exchange research globally at Deutsche Bank, stated that should the volatility persist, "the only choice left for the Fed would be to intervene with urgent buys of U.S. Treasury securities to steady the bond market." This move would mirror the action taken by the Bank of England after Liz Truss’s ill-fated 2022 mini-Budget.

Mr. Saravelos added, "Although we believe the Fed might manage to stabilize the market in the near term, we contend that reversing certain medium-term financial market changes will require a change in the policies implemented under the Trump administration."

The selling pressure on UK government bonds, or gilts, occurred as investors increasingly anticipated that the Bank of England might have to reduce interest rates more quickly than initially projected this year.

Many traders currently anticipate a minimum interest rate reduction of 0.25% at the upcoming meeting in May, with some even considering the possibility of a decrease as large as 0.5%.

The FTSE 100 falls 2.9 percent as trading ends.

17:13

,

Andy Gregory

The FTSE 100 stock index in London finished at a new 13-month low on Wednesday as European markets declined further post the initiation of President Donald Trump’s tariff policies.

The leading index of UK stocks ended the day down 2.92 percent, or 231.05 points, at 7,679.48.

The FTSE 250 index, which includes mid-sized companies, finished 2.5 percent down on Wednesday as well.

Trump "significantly erred" with regard to tariffs, according to an economist whose work was cited by the U.S. President.

16:55

,

Holly Evans

A well-known economist who collaborated on a study referenced by

Donald Trump

to justify his

aggressive tariff hikes

states that the White House "got it 'very wrong'."

The University of Chicago economics professor Brett Neiman, who previously served as an official in the Biden administration’s Treasury department, stated that

Trump

administration wildly overcalculated

tariff rates

implemented in almost every country that exports to the U.S.

The U.S. Trade Representative unveiled its findings and referenced a study conducted by four economists, one of whom was Professor Neiman, ostensibly backing their strategy.

Find the complete article here:

Trump 'made a significant error' with tariffs, according to an economist favored by the U.S. president.

Spain defends tighter economic partnerships with China following U.S. warnings about 'shooting oneself in the foot.'

16:50

,

Holly Evans

Spain aims to strengthen trade relations with China for the benefit of its people and the European Union, according to Agriculture Minister Luis Planas on Wednesday. He dismissed a U.S. caution that aligning more closely with the Asian nation could be self-destructive.

"We have excellent trade relations with China which we intend to not only continue having, but expanding," Planas told reporters from Ho Chi Minh City, where he was accompanying Spanish prime minister Pedro Sanchez on a trip to Vietnam and, on Friday, China.

Planas was responding to previous remarks made by U.S. Treasury Secretary Scott Bessent, who criticized Spanish Economy Minister Carlos Cuerpo for suggesting that Europe should move closer to aligning itself with China.

What you're suggesting would be like shooting yourself in the foot," Bessent said at a banking conference in Washington, also noting that China will keep overproducing commodities and flooding other markets with these products.

Sánchez and Planas are set to travel to Beijing in the coming days with aims to strengthen economic relations against the backdrop of worldwide disruptions caused by former U.S. President Donald Trump’s tariffs. They intend to establish Spain as a mediator between China and the European Union while also working to bring more Chinese investments into their country.

Trump isn't attempting to rejuvenate U.S.-Russia trade relations by exempting Russia from tariffs.

16:35

,

Holly Evans

On Wednesday, U.S. Trade Representative Jamieson Greer informed legislators that President Donald Trump was not attempting to rejuvenate trade relations with Russia by exempting their products from mutual or standard tariff rates. However, the decision regarding potential future levies remains solely with Trump.

Greer informed the U.S. House Ways and Means Committee that Russia was not included in the tariffs due to the extensive U.S. sanctions and sector-specific trade restrictions already imposed on it, similar to those faced by Belarus, Cuba, and North Korea.

U.S. Republican lawmakers voice worries about effects on retirees.

16:31

,

Holly Evans

Republican members of Congress are concerned that the market downturn caused by U.S. President Donald Trump's tariffs is having severe consequences for retirees and those nearing retirement age — an important voter base for their party.

Shares have dropped sharply during the past week as Trump initiated a trade conflict with key U.S. trading allies, while Treasury securities faced renewed selling pressure, impacting personal 401(k) plans and various investments that people depend on for their retirement needs.

Several GOP legislators voiced concern this week regarding potential damage to Americans' investments as the upcoming midterm elections approach, which could determine who controls both houses of Congress.

"Individuals will be reviewing their 401(k) statements. Some supported President Trump and also backed me. ... I am simply attempting to determine whether they will view this positively," stated Thom Tillis from North Carolina, one of seven Republican senators who have endorsed a cross-party legislation aimed at granting Congress the power to scrutinize and potentially rescind newly imposed tariffs.

Republican Senator John Kennedy from Louisiana voiced comparable apprehension.

Kennedy stated to reporters, "This isn’t enjoyable. I’m not fond of it. I prefer when the markets rise." He mentioned he intends to allow Trump’s strategy an opportunity, yet emphasized that the president should improve efforts in educating the populace regarding his immediate objectives.

We're unsure of the timeline for seeing positive outcomes, and we aren't certain about the potential short-term effects," Kennedy stated. "It’s also unclear whether the treatment might end up being more harmful than the condition itself.

Rachel Reeves agrees £128m export and investment deal with India

16:14

,

Holly Evans

The Chancellor has approved £128 million in new export agreements and investments with India.

Rachel Reeves and her Indian counterpart Nirmala Sitharaman signed a joint statement for a package that includes the new deals as well as recent ones worth £271 million after meeting in London.

This encompasses Paytm, India’s leading digital payments platform, planning investments in the UK, along with HSBC Bank’s strategy to increase its reach to 34 Indian cities from the current 14.

The Chancellor said: “In a changing world, it is imperative we go further and faster to kickstart economic growth.

We've heard from British companies, which is why we're working on trade agreements with nations around the globe, such as India, to assist them and boost funds in citizens' wallets as part of our Strategy for Transformation.

Our connection with India has been long-standing and wide-ranging, and I am thrilled with the advancements achieved through this discussion to enhance it even more.

U.S. markets remain stable as global markets experience upheaval.

15:55

,

Karl Matchett

As most international markets declined today, the U.S. saw gains in early trading sessions—the S&P 500 rose by 0.5 percent, the Dow gained 0.1 percent, and the Nasdaq climbed by 1.3 percent.

In the meantime, the president has turned to social media to imply “now is an excellent moment to purchase” — likely alluding to stocks instead of goods from China. However, prominent investor Bill Ackman does not concur with this view.

"If the president doesn't halt the impact of the tariffs shortly, numerous small enterprises will face bankruptcy. Medium-sized companies will follow suit," he posted on X.

The CEO of Pershing Square Capital stated, "Our stock market is experiencing a downturn. Meanwhile, bond yields have risen and the value of the dollar has fallen. Such indicators do not reflect effective policymaking."

Technology stocks boost Wall Street during intensifying U.S.-China tariff dispute.

15:45

,

Holly Evans

On Wednesday, Wall Street’s primary indices edged upward as investors took advantage of lower-priced tech stocks during a fluctuating trading day focused primarily on tariffs, following China’s retaliation with additional taxes on American products.

Many large-cap and growth stocks increased in value, with Apple and Nvidia both gaining approximately 2.5 percent each and Microsoft rising by 1.2 percent. As a result, the technology sector climbed by 1.5 percent overall.

"The urge to purchase during dips remains quite robust, and undoubtedly, the significant decline in tech stocks has made them more affordable compared to their previous prices," stated Chris Beauchamp, chief strategist at IG.

Even with initial progress, all three indexes had fallen by over 10 percent compared to the values observed prior to the announcement of reciprocal U.S. tariffs the previous week.

The EU labels Trump's tariffs as 'unjustified' as they approve retaliatory measures.

15:29

,

Holly Evans

The European Union has approved retaliatory tariffs on $23 billion (£18bn) worth of American products, stating that President Trump’s tariffs are "unjustified and harmful."

The tariffs will be implemented gradually, starting on April 15 for some items and on May 1 and December 1 for others. On Wednesday, the EU executive commission did not promptly supply a catalog of the affected products.

Representatives from the 27-nation group reaffirmed their desire for a mediated agreement to resolve trading disputes.

In a statement, the commission remarked, “The EU views the US tariffs as unwarranted and detrimental, inflicting economic damage on both parties along with worldwide repercussions. The EU has consistently expressed its strong inclination toward reaching agreeable solutions with the US that ensure equilibrium and mutual advantage.”

Ursula von der Leyen, who leads the European Commission, has proposed eliminating all tariffs on industrial products such as vehicles between the EU and the U.S. However, President Trump maintains that this proposal does not adequately address American concerns.

Walmart, the retail giant, intends to maintain affordable pricing despite issues with tariffs imposed under the Trump administration.

15:19

,

Holly Evans

On Wednesday, Walmart reaffirmed its annual sales and profit guidance, committing to maintain competitive pricing despite concerns about a potential global downturn sparked by U.S. President Donald Trump’s extensive tariff implementations.

Since the announcement of a series of tariffs on April 2nd, causing their stock price to drop almost 9 percent, the corporation’s shares saw an increase of roughly 5 percent during early trading sessions.

As the largest U.S. importer of containerized products, Walmart faces potential setbacks due to Trump's tariffs, particularly those imposed on various goods coming from Asian nations, including apparel, toys, and more, which the retail giant relies on heavily.

"At a two-day investor conference in Dallas, Texas, which began on Tuesday, Walmart CEO Doug McMillon stated, 'We have mastered the art of navigating through chaotic times,'" he noted.

Although we cannot predict every event that will occur, we are clear about our top priorities and our main goals. We aim to keep costs at their lowest possible levels," he stated. "We also intend to concentrate on efficiently handling our stock and reducing expenditures.

In February, the corporation projected that for the fiscal year concluding in January 2026, sales would climb by 3 percent to 4 percent, with the yearly adjusted operating income expected to grow by 3.5 percent to 5.5 percent.

The Swiss president anticipates finding a resolution with Trump shortly.

15:12

,

Holly Evans

Swiss President Karin Keller-Sutter said on Wednesday she had spoken to U.S. President Donald Trump by telephone about trade and that she was looking forward to working out solutions in the very near future.

"In today's phone call with President Donald Trump I conveyed both Switzerland's stance on bilateral trade, and ways to address U.S. ambitions," she said on X. "We agreed to continue talks in the interest of both our countries. Looking forward to working out solutions in the very near future."

China releases travel warning for visitors heading to the U.S.

15:10

,

Holly Evans

China on Wednesday issued a risk alert for Chinese tourists travelling to the U.S., according to a statement from the culture and tourism ministry.

The ministry advised Chinese tourists to evaluate the hazards of visiting the U.S. and urged them to proceed with caution, highlighting the recent "decline in Sino-American economic and trade ties along with the worsening domestic security conditions in the country."

"BE COOL," Trump advises via social media.

15:00

,

Holly Evans

Shortly after the U.S. markets commenced trading, Donald Trump posted on his social media platform Truth Social: "STAY CALM!"

All will turn out for the best. The USA will grow even greater than before!

He sent another message right after, this time in all caps: "NOW IS THE BEST TIME TO PURCHASE!!! DJT."

"It's an evolving world," Starmer states, emphasizing that the UK needs to increase its efforts.

14:47

,

Holly Evans

Doing a trade deal with the US or changing the rates of American tariffs will not be “enough”, Sir Keir Starmer has said, insisting the world has changed and the UK needed to act differently.

Asked by ITV’s Peston if the 10% tariff on importing goods to America would be in place forever, the Prime Minister replied: “Look, I don’t know.

We are engaged in talks, and our aim is to enhance the circumstances; however, what I am suggesting is that believing merely altering the rates or striking a deal will suffice is incorrect. In my view, similar to how we have approached defense and security—acknowledging that the world is evolving—we must elevate ourselves and adopt new approaches.

In that scenario regarding defense spending, improving coordination across Europe is essential, as well as doing the same for trade and economic matters.

“We are actually, there’s a changing world, we’re entering a new era. We have to think and behave in a way that reflects that, and that’s why we’ve turbocharged what we’re doing on the economy.”

Charted: Which UK Cities May Suffer Most from Trump’s Tariffs?

14:34

,

Holly Evans

US

tariffs

are expected to trigger an "asymmetrical storm"

across the UK

with

Coventry

anticipated to suffer the most, a research institute has cautioned.

The

West Midlands,

The birthplace of British car manufacturing, with Wales playing a substantial role as a key contributor to the industry.

steel

, are likely to bear the main impact of the

economic impact

caused by

Donald Trump’s intensifying trade conflict

, a study by

Centre for Cities

shows.

The

10 per cent tariff

On every import, we'll observe the price of British products increasing across the Atlantic, ranging from handcrafted cheeses and beers to

cars

and machinery.

You can read the entire article here:

Charted: Which UK Cities May Be Most Affected by Trump’s Tariffs?

The U.S. Treasury Secretary suggests potential tariff agreements with allied nations.

14:28

,

Holly Evans

U.S. Treasury Secretary Scott Bessent stated on Wednesday that he believes the Trump administration could secure tariff agreements with American allies as he gets ready to spearhead talks involving more than 70 nations in the upcoming weeks; however, China stands out as an exception because of its retaliatory actions.

Speaking at an American Bankers Association conference in Washington, Bessent stated that he will assume a leading negotiation role regarding President Donald Trump's tariff discussions.

He further stated that even with the turbulence in the financial markets, “overall, the businesses I’ve communicated with, the individuals who have visited, the CEOs who have gone to the Treasury, inform me that the economy remains quite robust.”

Fiscal rules will persist in a 'quiet manner' even amidst market turmoil.

14:21

,

Holly Evans

Despite the market upheaval that pushed 30-year gilt yields to their highest level since 1998, the Prime Minister stated that the Government’s financial regulations remain unchanged.

Sir Keir Starmer informed ITV’s Peston: "The fiscal rules were established with a specific aim; they're unbreakable and not open to negotiation."

He stated, "They won’t alter their stance; our actions are driven by what’s best for the nation."

Those financial guidelines form the bedrock of the stability we've introduced to our economy, allowing us to move forward calmly.

The EU Commission gains support for initial responses to Trump's tariff moves.

14:14

,

Holly Evans

The European Union Commission has said it has secured backing from EU countries for the first countermeasures against US tariffs, which will be enforced on 15 April.

The group of 27 countries stated that these retaliatory measures can be put on hold anytime if the US commits to reaching a fair and equitable agreement through negotiations.

Opinion: Maga is experiencing chaos – but the juvenile ranting needs to end

13:49

,

Jane Dalton

Maga is in turmoil – but the juvenile trash-talking needs to end.

Comic's biting critique of Trump's policies becomes an online sensation

13:34

,

Jane Dalton

Dave Chappelle’s biting critique of Trump’s policies gains traction online as tensions rise over the trade war.

JD Sports states that the effect of tariffs continues to be 'unclear'.

13:06

,

Holly Evans

JD Sports has said it expects trading conditions to be “volatile” throughout the year as the potential impact of changes to tariffs remains “uncertain”.

This occurred when the high street retailer announced a minor rise in revenues for the previous quarter, mainly due to strong performance from its European operations.

The firm stated that like-for-like sales increased by 0.3 percent during the quarter ending February 1, accompanied by an organic revenue rise of 5.6 percent.

The company has outlined intentions to launch approximately 150 new stores this year, finalize about 100 store transformations or upgrades, and shut down roughly 50 outlets, primarily located in Eastern Europe.

Who will suffer the most from the China-US trade war with the president threatening a 104% tariff?

12:57

,

Holly Evans

President Donald Trump has ramped up his

trade war with China

, imposing an astounding 104 percent duty on products brought into the U.S.

This action will significantly impact American consumers as Chinese imports span key sectors and supply chains, with Apple’s iPhone particularly affected.

The elevated tariffs were imposed following China’s retaliation with similar actions of their own, resulting in an ongoing cycle of reciprocal charges between the nations.

Check out the complete analysis by my colleagues Alicja Hagopian and Millie Cooke here:

Who will suffer the most from the China-US trade war now that Trump has raised tariffs to 104%?

Liberal Democrat leader states Trump is an 'untrustworthy partner.'

12:48

,

Holly Evans

Liberal Democrat leader Sir Ed Davey has criticised US President Donald Trump’s rising trade war with China.

“It’s dreadful from the President of the United States,” Sir Ed said during a local election visit to Gloucester.

You know, we've had presidents from various political backgrounds whom we could count on. However, I'm concerned that Donald Trump is an unpredictable partner. When it comes to defense and supporting Ukraine against the problematic President Putin, he falls short.

Now his stance on trade has become unpredictable, affecting not only China but also the UK, and our close allies like Canada.

I believe we should confront him. It’s appropriate for Number 10 to be communicating with the White House.

“I believe they also require a different approach concurrently, which involves being more stringent and collaborating with our European partners, Commonwealth allies, and others to form an economic coalition of the willing aimed at advancing free trade.”

FTSE drops following China’s announcement of additional tariffs

12:41

,

Holly Evans

The FTSE 100 continued to decline significantly during the middle of Wednesday following China’s announcement of 84 percent retaliatory trade tariffs on U.S. goods.

The blue-chip index in London dropped as much as 3.6 percent, or 289 points, reaching down to 7621, but then recovered somewhat from those losses.

Germany’s DAX index dropped by 3.5 percent, whereas France’s CAC 40 fell by 3.6 percent soon after the statement was made.

Escalating China-US tariffs 'a heavy blow to existing economic order'

12:35

,

Alisha Rahaman Sarkar

So far, China’s reaction to Donald Trump's staggering 104 percent tariffs has remained “calm, restrained, and proportional,” according to Dylan Loh, an author and assistant professor at Singapore's Nanyang Technological University.

Loh was speaking to

The Independent

Shortly before China declared it would increase its retaliatory tariffs from 34 to 84 percent on Wednesday afternoon.

Beyond tariffs, China has a number of ways it can respond to Mr Trump, both "economic and non-economic", he says. "There are still a slew of policy options. China could, for instance, go after services, which is immense. They could expand the lists of critical minerals banned, or target the agricultural industry in the US," Mr Loh said.

He states that the complete effect on worldwide commerce hinges upon how this tariff conflict unfolds. However, he adds, "the strike against the current economic framework—which was supported by the U.S. with respect to trading regulations and standards—is quite severe."

This will have significant implications for international exporters and U.S. importers. It will reduce economic investment, prompting businesses and individuals to cautiously restrict spending beforehand.

He mentioned that China might increase its endeavors to boost domestic spending. Should China implement thorough internal economic and social changes to genuinely unleash consumer demand, the country would not have to export as extensively as it does now.

China voices 'serious apprehension' at the World Trade Organization regarding the 'impetuous' Trump tariffs.

12:29

,

Holly Evans

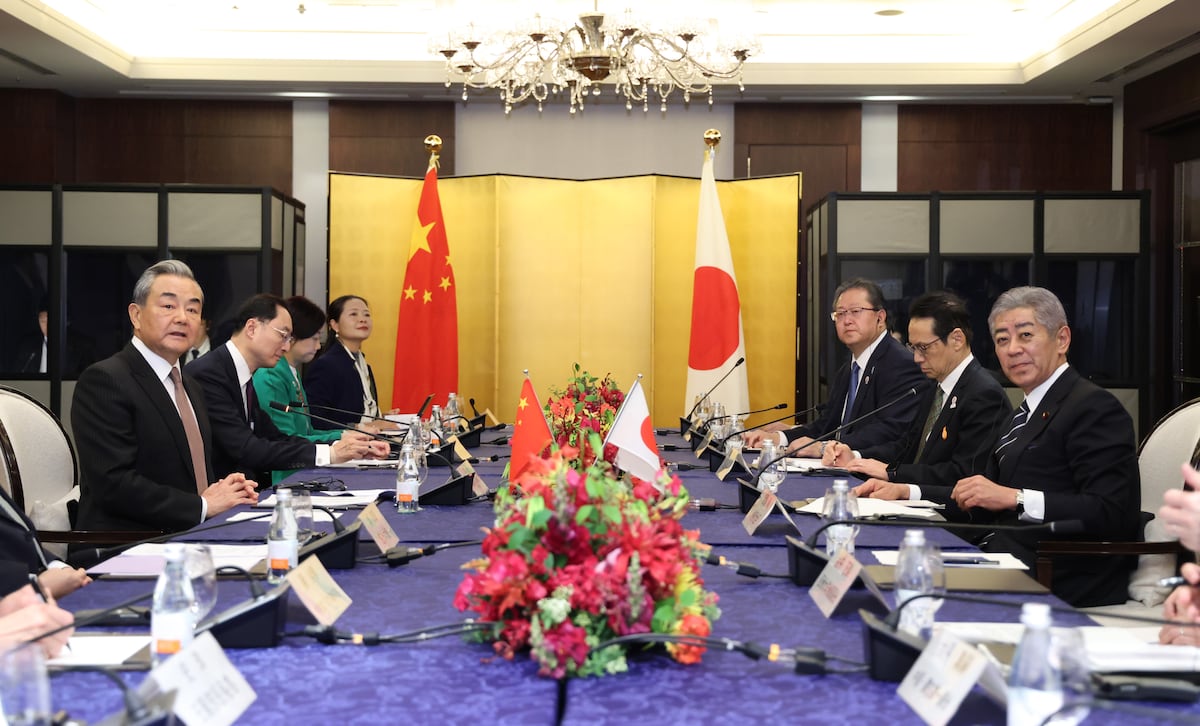

China informed the World Trade Organization on Wednesday that the U.S.'s move to enforce so-called reciprocal tariffs on Beijing risks exacerbating instability in worldwide commerce even more.

"The circumstances have perilously intensified. As an entity impacted by this issue, China conveys deep apprehension and strong disapproval towards this hasty action," stated China in a communication to the WTO on Wednesday, which was relayed to Reuters via the Chinese mission to the WTO.

President Donald Trump's "tit-for-tat" tariffs came into play on Wednesday for numerous nations, imposing substantial 104% taxes on products from China. This move prompted the European Union to prepare countermeasures, intensifying an international trade conflict.

At a World Trade Organization gathering focused on merchandise trade, China informed members that the retaliatory tariffs contravened the organization’s regulations and weakened the global trading framework.

"The reciprocal tariff is neither a solution nor will it ever become one for addressing trade imbalances. Conversely, these tariffs will have adverse effects and end up hurting the United States itself," stated China’s representation to the WTO.

Breaking News: China Plans Additional Tariffs at 84% on Goods from the USA

12:13

,

Holly Evans

China will implement tariff increases to 84 percent on U.S. products starting Thursday, up from the initially declared 34 percent, according to an announcement made by the finance ministry on Wednesday.

Germany's Merz seals alliance agreement amid concerns that Trump tariffs could trigger a downturn.

12:08

,

Holly Evans

The German conservatives led by Friedrich Merz reached a coalition agreement with the center-left Social Democrats (SPD) on Wednesday. Their aim is to rejuvenate growth in Europe’s biggest economy amid threats of a global trade war potentially leading to a recession.

The agreement marks the end of several weeks of negotiations between incoming Chancellor Christian Democrats' leader Merz and the Social Democratic Party following his victory in the February election. However, he did not secure an outright majority, as the far-right Alternative for Germany party emerged as the runners-up.

The urge to finalize an agreement has intensified due to the growing instability globally, exacerbated by the rising trade tensions initiated by U.S. President Donald Trump’s extensive import duties, coinciding with the government stepping into power during these tumultuous times.

The conservative CDU-CSU coalition and the SPD plan to unveil their agreement for forming a new government at 3:00 p.m. (1300 GMT), according to statements from the CSU party.

Merz, who described Trump's America as an untrustworthy partner, has previously committed to increasing defense expenditures amid Europe’s confrontation with a belligerent Russia. Additionally, he plans to bolster assistance for enterprises grappling with elevated expenses and sluggish consumer demand.

Watch: Brexit to blame for London’s millionaire exodus, Lisa Nandy says

11:56

,

Holly Evans

The Chancellor reaffirms that 'every option' is still being considered for British Steel.

11:51

,

Holly Evans

Chancellor Rachel Reeves has reiterated that “every option” remains available regarding the future of British Steel, amid growing concerns about the firm’s operations in Scunthorpe.

"The government acknowledges the significance of these positions in Scunthorpe and the surrounding region, and we are taking every possible measure to safeguard these jobs and assist those communities," she stated.

We are currently engaging with both the owners and labor unions to reach an agreement.

This follows Sir Keir Starmer’s statement that all possibilities were still under consideration amidst speculations about potential nationalization of the firm by the UK.

British Steel has initiated consultations regarding the potential shutdown of blast furnaces at its facility in Scunthorpe, and discussions between the government and the company’s Chinese owner, Jingye, have been ongoing.

Calls have been made for short-term nationalization due to concerns about potential massive layoffs.

Kemi Badenoch states that a UK-US trade agreement should aim for 'reciprocal benefits.'

11:33

,

Holly Evans

Britain doesn’t have to reduce food standards or agree to compromises in a trade agreement with the U.S., according to Kemi Badenoch, but should aim for "reciprocal benefits" instead.

While visiting Worcestershire for a local election event, the Conservative leader was questioned about whether she would allow chlorinated chickens into the UK or eliminate a levy on large technology firms if she were involved in negotiations with the U.S.

Ms Badenoch, who previously served as business secretary, responded: "Trade agreements aren’t about exchanging blows or making concessions. They’re about mutual benefits."

I previously served as a trade secretary. I was involved in finalizing the largest trade agreement post-Brexit—the Trans-Pacific Partnership. We managed to maintain our food safety standards without compromising them. For instance, when countries such as Canada requested adjustments to these standards, I rejected altering the existing trade agreements.

She added: “So, we don’t need to do things like that. We need to look at where there are opportunities. You look at mutual gain, recognising mutual professional qualification, bringing tariffs right down.

This is what Keir Starmer should undertake. My concern is that he might enter into a trade agreement that merely puts us right back where we started from last week. Instead, what we truly require is a trade deal aimed at shaping the future rather than clinging to the past.

Leader convenes with prominent financial officials to address implications of Trump tariffs

11:23

,

Archie Mitchell

This morning at the Treasury, the chancellor held a meeting with top executives from banks and investment firms. They pledged to protect "working individuals" from the effects of Donald Trump’s tariffs.

Present at the gathering were Lloyd’s CEO Charlie Nunn, Hargreaves Lansdown head Dan Olley, along with various other industry leaders.

Ms. Reeves committed to strengthening relationships with international partners outside the U.S. to enhance trade, whereas Britain aims to negotiate an agreement with the Trump administration to reduce or eliminate tariffs on British goods.

After the gathering, a spokesperson from the Treasury stated: "Today, the Chancellor and Economic Secretary convened critical stakeholders within the sector to advocate for the UK as an attractive destination for investments due to our consistent political environment, continuous improvements in our stock markets, and our dedication to enhancing the UK’s consumer investing landscape along with fostering expansion through our Strategy for Transformation."

Which Asian nations heavily impacted by Trump’s tariffs are taking actions to protect their economies?

11:13

,

Holly Evans

Major economies in Asia were scrambling to safeguard their financial interests as

Donald Trump

's

impose "reciprocal" tariffs on numerous nations

came into force on Wednesday.

The US president's

tariff hike to its highest in over 100 years

has sparked concerns about an economic downturn and

wiped out trillions of dollars from the stock

market value. The deteriorating worldwide conditions

trade war

has faced condemnation from investors and led top economists to

JPMorgan

and Goldman Sachs to increase the likelihood of a recession.

On Tuesday, Mr. Trump boasted about the impact.

Countries were "bending over backwards" for me.

.

"They are eager to strike a deal – 'please sir, make a deal, I will do whatever you want, anything at all sir'," he stated.

You can read the entire article here:

Which Asian nations heavily impacted by Trump's tariffs are taking actions to protect their economies?

Reeves states she aims to avoid 'a rise in tariff rates.'

11:08

,

Holly Evans

Chancellor Rachel Reeves stated that she aims to avoid "an increase in tariffs" following the implementation of Donald Trump's global tariff measures.

Addressing the broadcasters, she stated: "Trade wars serve nobody's interest, which is precisely why in the UK we are maintaining our composure and staying practical."

We will consistently operate in the national interest of our country to foster job creation and support British businesses.

That’s what we’ll keep doing as long as we’re engaged in talks with our colleagues from the United States.

We aim to avoid increasing tariff levels. Our preference is to negotiate an agreement that benefits the UK’s economic growth.

The bank cautions that global stability risks increase due to potential U.S. tariff impacts on economic expansion.

11:04

,

Holly Evans

The Bank of England has cautioned that risks to the stability of the global financial system have risen due to potential US tariff impacts which might burden worldwide economic expansion.

Despite facing challenges, households and businesses continue to show resilience, and the UK banking system is well-prepared to support them during stressful periods, according to the Bank’s Financial Policy Committee (FPC) in their most recent report.

"The overall risk situation has worsened and uncertainties have become more pronounced," the FPC concluded.

The likelihood of negative occurrences, along with the possible intensity of their effect, has increased.

Following US President Donald Trump’s announcement of increased tariffs on all imported goods into the USA, countries such as China responded with counter-tariffs.

A significant change in worldwide trade agreements might "undermine economic stability by reducing growth," according to the Bank.

These risks hold particular significance for the UK due to its status as an open economy featuring a substantial financial sector.

According to the FPC, UK household borrowers, including those with mortgages, along with businesses carrying debt, have generally shown resilience overall.

The EU plans to vote on implementing 25 percent retaliatory tariffs on American goods.

10:53

,

Holly Evans

The nations within the European Union are anticipated to endorse on Wednesday the union’s initial steps for responding to the tariffs imposed by U.S. President Donald Trump. This move will align them with countries like China and Canada as they retaliate and intensify what might develop into a worldwide trade war.

The endorsement will be issued on the same day when Trump’s “reciprocal” tariffs against the EU and numerous nations went into effect, featuring exceptionally high 104 percent duties on goods from China. This escalation extended his aggressive use of tariffs, leading to broader sell-offs throughout various financial markets.

The 27-member union confronts 25 percent import duties on steel and aluminum, along with levies on vehicles. Additionally, they face expanded tariffs of up to 20 percent on nearly all other products due to President Trump’s strategy aimed at retaliating against nations that create significant obstacles for American exports.

On Monday, the European Commission, responsible for coordinating EU trade policies, suggested imposing additional duties primarily at a rate of 25 percent on various American goods. This move directly addresses the recent U.S. metals tariffs. The commission continues to evaluate its stance on potential responses to both automotive-specific and wider-ranging taxes.

The imported items encompass motorcycles, poultry, fruits, timber, apparel, and dental floss, as indicated in a document reviewed by Reuters. These imports amounted to approximately 21 billion euros ($23 billion) for the previous year, implying that the European Union’s countermeasures will target merchandise valued at under the 26 billion euros worth of EU metal exports affected by American tariffs.

European markets declined on Wednesday amid ongoing instability.

10:47

,

Holly Evans

Today, Europe is largely mirroring the trajectory of the FTSE 100, which has declined by just over two percent within the first few hours of trading.

The 250 index and the AIM have dropped slightly less, whereas France’s CAC 40, Germany’s DAX, and the Euronext 100 have all fallen within the range of 2.2% to 2.4% during Wednesday morning trading.

In telecommunications, travel, and finance sectors, losses are being observed across these markets, along with some energy stocks. The S&P 500 futures have recovered somewhat from their previous lows but remain unchanged at present, whereas Nasdaq futures are showing an increase of 0.4 percent.

China blocks certain tariff-related material on social media.

10:28

,

Holly Evans

On Wednesday, China started censoring certain tariff-related information on social platforms following the implementation of reciprocal tariffs imposed by the U.S., which included significant 104% duties on Chinese products. Meanwhile, postings denouncing the U.S. became widely popular.

Searches and hashtags related to "tariff" or "104" were largely restricted on the social media site Weibo, resulting in error messages appearing instead of content.

Other trending hashtags on Weibo included topics related to the U.S. experiencing an egg shortage. The state-run broadcaster CCTV initiated the hashtag "#USShortageOfEggsDueToVariousReasons."

The U.S. is "brandishing the tariff sword prominently by imposing duties on EU steel and aluminum goods," yet simultaneously sending confidential messages to European nations pleading for support, according to a CCTV post on Weibo.

Last week, Beijing imposed retaliatory tariffs on the U.S. and has pledged to combat what it sees as extortion.

Online censors have permitted satirical remarks about the U.S. to spread across Chinese social platforms, portraying America as an unreliable global trading counterpart, as China gears up for a broader trade dispute with the planet’s leading economic power.

UK banks face challenges as the threat of a worldwide economic downturn approaches.

10:18

,

Karl Matchett

Once more, British banks are facing severe criticism in the early morning trading sessions of the market.

Barclays (-3.6%), Standard Chartered (-3.6%), HSBC (-3%), Lloyds (-2.5%), and NatWest (-2.5%) are all experiencing declines; it’s important to recognize that this downturn has several contributing factors within their finances.

Initially, we certainly face the possibility of an impending worldwide economic downturn; with individuals having reduced funds for spending and enterprises performing poorly, lenders and borrowers alike will likely see diminished returns.

Additionally, there is increasing pressure on the Bank of England to significantly reduce the base interest rate in the coming months. This move could compress the profit margins that banks have become accustomed to during the last one or two years.

For instance, among the examples mentioned earlier, Lloyds is much more domestically oriented compared to Standard Chartered. Therefore, a broader economic decline would likely impact these international banks more significantly. So far, it seems that Asia might face greater challenges than the UK, which partially accounts for why Standard Chartered has dropped by 26% over the past month, whereas Lloyds has only decreased by 8% during the same period.

UK government bond yields hit their peak level since 1998.

10:09

,

Holly Evans

British long-term bond yields have hit their peak since 1998, while the FTSE 100 declined following President Donald Trump's imposition of new tariff measures.

On Wednesday morning, the return on a 30-year UK government bond reached 5.518 percent, marking an increase of 16 basis points and exceeding the previous 27-year peak of 5.472 percent established in January.

The trend continued following a significant increase in 30-year US Treasury yields during the night and occurs as investors increasingly anticipate that the Bank of England might reduce interest rates more quickly than initially projected for this year.

Shorter-dated 10-year gilt yields were slightly higher at 4.69 per cent while two-year yields ticked down at 3.92 per cent.

The FTSE 100 dropped 2.47 percent, losing 195 points, to stand at 7,715 during Wednesday morning trading.