Traveling has consistently been thrilling, yet handling finances across various nations was previously quite cumbersome. Switching from Bitcoin to US dollars prior to journeys and subsequently converting those dollars back into local currencies was once both intricate and tedious.

By 2025, cryptocurrency payment systems have revolutionized international financial transactions, simplifying travel budgeting and enhancing convenience for travelers. These systems facilitate instant currency exchanges at competitive market rates.

The Development of Travel Payments

Prior to the widespread adoption of cryptocurrency for travel, tourists frequently managed various payment options —cash in local currency, credit cards charging hefty foreign transaction fees, and prepaid travel cards requiring frequent top-ups. These choices each came with their own issues: cash risked being lost or stolen, card payments sometimes got rejected, and keeping tabs on expenditures denominated in several currencies proved cumbersome.

By 2025, integrated cryptocurrency payment systems have tackled numerous obstacles. Now, travelers can utilize digital wallets linked to major payment networks, enabling direct payments using cryptocurrencies or automatic conversion into local currencies at the time of purchase.

How Today's System Works

The present cryptocurrency travel payment system comprises various interlinked components functioning cohesively:

Most travelers nowadays utilize multifunctional digital wallets designed for multiple currencies. These wallets can hold different types of cryptocurrencies and typically sync with smartphones and smartwatches, facilitating easy contactless transactions through a quick tap.

Currency Rate Security: Contemporary travel cryptocurrency applications allow users to secure advantageous exchange rates for their intended locations prior to leaving home. This aids travelers in planning their budgets precisely, eliminating concerns over unexpected changes in currency values.

Cryptocurrency Payment Systems: Leading cryptocurrency payment networks have expanded worldwide through partnerships, ensuring they are accepted at accommodations like hotels, eateries such as restaurants, travel services including transportation, and various points of interest in most popular tourism spots.

Expense Monitoring: The system automates expenditure tracking by sorting expenses into categories and gives instant feedback on whether travelers are adhering to their set budget plans.

Offline Functionality: Many cryptocurrency payment systems currently provide offline transaction options, enabling basic buying even in regions with restricted online access.

Benefits for Careful Travelers

The transition to cryptocurrency has not led to reckless spending; instead, it has had the contrary effect. These novel systems come equipped with mechanisms that assist travelers in keeping their finances under control.

Expenditure Caps: Individuals have the option to establish daily or weekly expenditure limits aimed at curbing spontaneous buying behaviors outside of their predefined financial plan.

Category budgets enable digital wallet users to assign particular sums for various components of their trip such as lodging, meals, experiences, and keepsakes, complete with notifications when they near these spending caps.

Shared Wallets for Group Expenses: These tools simplify cost-sharing among travel companions like friends or relatives, making joint trips easier by eliminating the previous hassle of uneven financial splits.

Real-Time Currency Conversion View: During transactions, travelers can view both the cryptocurrency amount and its corresponding value in their local currency, enhancing understanding of their expenditures.

Security Improvements

The cryptocurrency travel systems of 2025 have tackled earlier security issues via multiple advancements:

Biometric Authentication: Transactions demand either a fingerprint or facial scan, which makes unauthorized payments extremely unlikely, even if your device gets misplaced or taken.

Many cryptocurrency travel platforms now offer transaction insurance to protect against fraud or technical issues, ensuring tranquility for travelers.

Emergency Backup Access: Designated contacts can assist in regaining fund accessibility if primary devices are misplaced, preventing travelers from being left resourceless when out of their home country.

Selective Data Disclosure: The privacy functions enable travelers to manage which details merchants obtain during exchanges, thereby decreasing exposure of sensitive information.

Practical Usage Examples

The straightforward nature of contemporary cryptocurrency transactions for travel expenses becomes evident in daily situations:

Upon reaching a new location, travelers now have no need to seek out currency exchange booths or ATMs. Transport services from the airport can be easily covered with just a tap of your wristwatch or smartphone.

Street markets and small vendors that previously accepted only local currency now frequently show QR codes for cryptocurrency transactions, simplifying impromptu buying experiences.

Dividing a restaurant check among traveling buddies occurs seamlessly via group wallet functions, where everyone’s contribution is computed and withdrawn immediately.

Hotel deposits are managed using temporary holds instead of immediate charges, which makes the funds that were once unavailable until check-out now accessible.

Challenges and Considerations

Even with notable advancements, cryptocurrency-based travel payments still come with various concerns:

1. Volatility of crypto values can affect transaction outcomes.

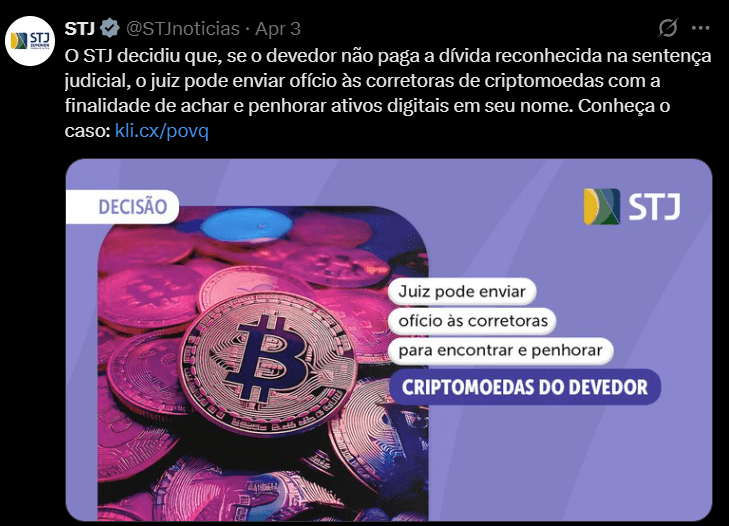

2. Regulatory uncertainties pose potential risks for both travelers and merchants.

3. Widespread acceptance remains limited compared to traditional payment methods.

These factors mean that while progress has been made, challenges persist in integrating cryptocurrencies fully into travel payments.

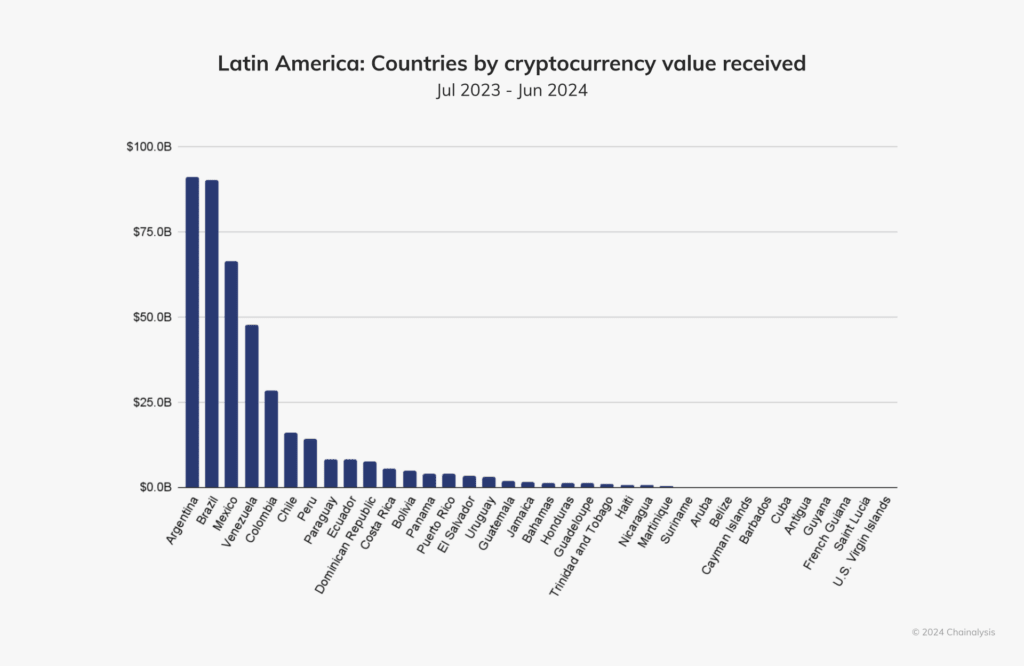

Although some far-off places still exhibit restricted adoption, this discrepancy keeps shrinking as worldwide infrastructure develops further.

For new users, there is an initial learning period; however, simpler user interfaces have significantly eased the first steps compared to earlier years.

While battery reliance continues to be an issue, power banks and fast-charging options have turned into typical travel essentials.

A Balanced Perspective

Although cryptocurrency has made travel payments easier, it hasn't altered the significance of prudent expenditure. This tech offers improved resources for making well-informed choices and adhering to planned budgets.

In 2025, for travelers, the main benefit isn't about having extra money to spend; instead, it's about being free from financial worries and bureaucratic hurdles that used to complicate global expeditions.

By eliminating these obstacles, integrating cryptocurrency payments enables individuals to concentrate on what truly counts — exploring new destinations, immersing themselves in different cultures, and making meaningful connections without constantly fretting over financial logistics.

Provided by Syndigate Media Inc. (

Syndigate.info

).