Judges in Brazil now have permission to confiscate cryptocurrency holdings from individuals who owe debts and are delinquent in their payments. This move indicates an increasing acknowledgment that virtual currencies serve as both a means of settlement and a repository for wealth.

According to local media reports The Third Panel of Brazil’s Superior Tribunal de Justiça has unanimously approved a measure allowing judges to issue letters to cryptocurrency exchanges. These letters will notify the exchanges of the intention to freeze an individual's assets in order to compensate their creditors.

The report was validated by the Superior Court of Justice, which posted an announcement on its website.

The unanimous decision was made by the Third Panel after they examined a case presented by a creditor.

“Although they are not legal tender, crypto assets can be used as a form of payment and as a store of value,” a translated version of the Superior Court of Justice’s memo read.

According to current regulations, Brazilian judges have the authority to freeze bank accounts and initiate fund transfers, even without informing the debtor, if they determine that a creditor is entitled to payment.

After the latest ruling, cryptoassets now come under the same jurisdiction.

Minister Ricardo Villas Bôas Cueva, part of the five-member committee, stated during the voting process that cryptocurrencies remain unregulated in Brazil. However, he acknowledged that some proposed bills have categorized these assets as "a digital representation of value."

Related: Brazil’s data watchdog upholds ban on World crypto payments

Even with regulatory ambiguity, Brazil stands as a key center for cryptocurrency.

Even though Brazil doesn’t yet have a comprehensive regulatory framework for digital assets, the nation’s central bank is involved. divvying up The regulatory procedures have been divided into stages, leading to a rapid increase in cryptocurrency adoption nationwide.

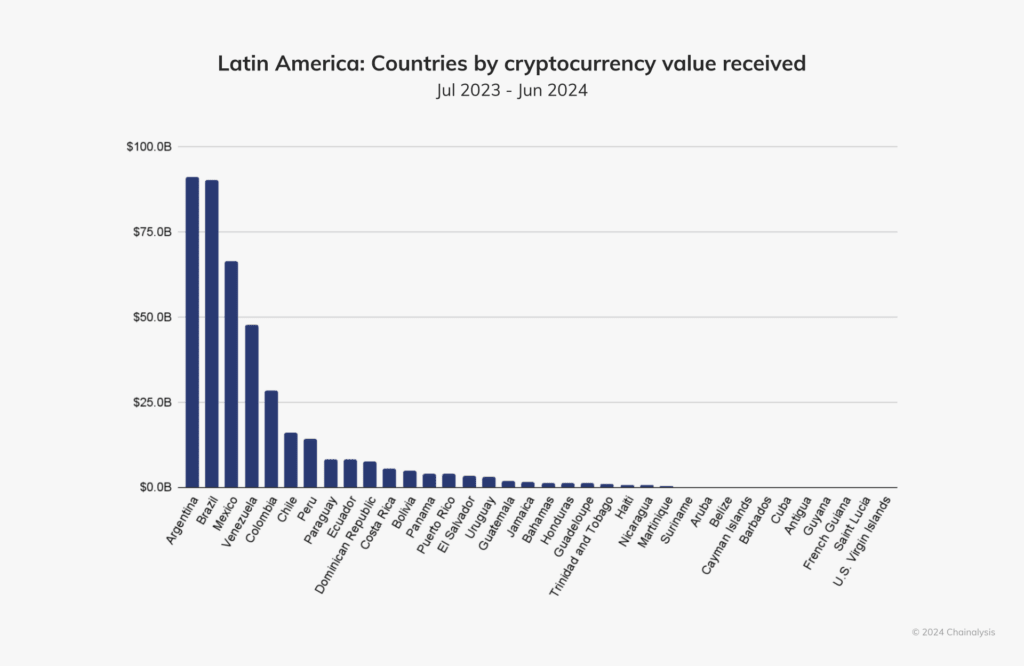

According to a report released in October by Chainalysis, Brazil stands as the second-highest country in Latin America regarding "crypto value received," making it a significant indicator of adoption.

earlier this year, the cryptocurrency exchange Binance was given permission to function within the nation following its acquisition of a São Paulo-based investment firm.

A representative from Binance informed Cointelegraph back then that Brazil was advancing "substantial progress" towards regulating the sector and anticipated a complete regulatory structure would be completed "by the middle of this year."

However, not all of Brazil’s proposed regulations have been beneficial for the industry.

In December, the nation's principal banking institution proposed banning stablecoin transactions On self-managed wallets as more residents started utilizing dollar-linked tokens to protect themselves from the depreciation of the Brazilian real.

Industry analysts informed Cointelegraph at the time that implementing such a ban would likely be challenging to execute.

Centralized exchanges may be regulated by governments, yet peer-to-peer transactions and decentralized platforms pose greater challenges for oversight," noted Lucien Bourdon, an analyst at Trezor. "This suggests that such bans might impact just a segment of the overall system.

Related: Brazilian legislator proposes bill for regulating bitcoin-based payrolls