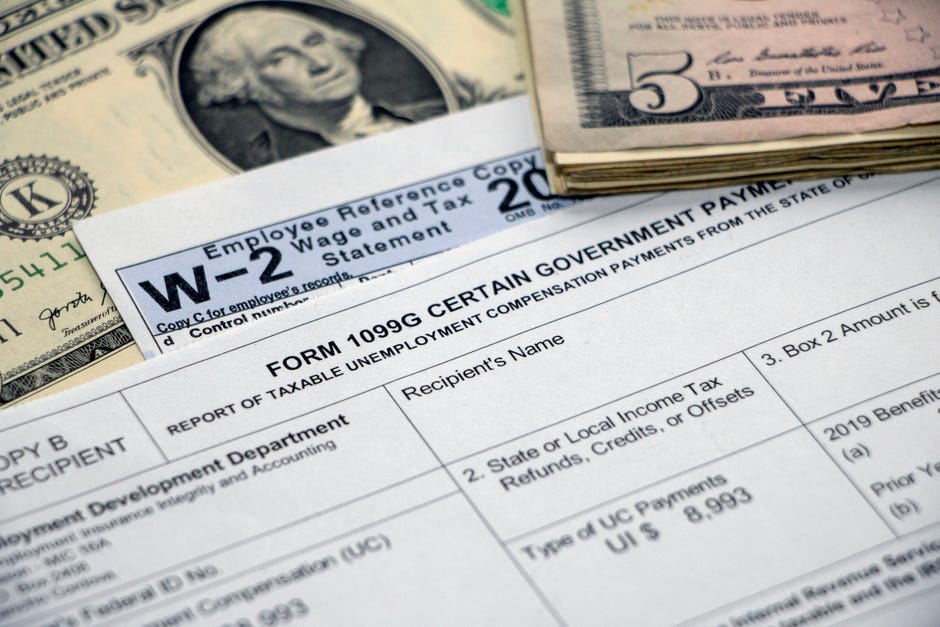

We're just about a month away from the tax deadline , so if you still haven’t submitted your taxes, you may be thinking about employing an expert to handle them. Although you could file on your own at no cost, engaging a seasoned tax preparer can alleviate anxiety, particularly if you’re new to this procedure or unsure about potential tax credits you qualify for. Nonetheless, the Internal Revenue Service swiftly advises filers that they ought to be careful when choosing a tax preparer to manage your filing.

According to a new survey More than 44% of individuals preparing their tax returns experience anxiety or fear regarding the process this year, with Generation Z and Millennials being at the forefront. A significant portion of these concerns stems from the possibility of errors during tax filings, which is why numerous people choose to enlist professionals for assistance.

I spoke with Jassen Bowman, an IRS enrolled agent and tax specialist, for more insight into why selecting your tax preparer carefully matters significantly. He explained, “Your tax return includes all the data needed to steal identities and carry out multiple kinds of fraud.” According to him, criminals are drawn to the tax preparation industry as they seek opportunities to perpetrate these offenses and deceive individuals.

There's a lot of money at stake for sure: The IRS has already sent out over $124 billion So far, we've processed refunds. Perhaps you’re still organizing your documents for next year’s 2024 taxes. The IRS emphasizes the importance of making well-informed choices when selecting an individual to handle your tax filings. For additional information about taxes, be sure not to miss out on our insights for 2025. tax cheat sheet including crucial advice you ought to be aware of.

Ready to file your taxes? Get started with one of 's partner offers.

Prepare your own taxes online for free

In addition to providing a free way to file your taxes, IRS reminds taxpayers that some eligible individuals can also get free tax help through Volunteer Income Tax Assistance or Tax Counseling for the Elderly. Generally, VITA services are reserved for people who earn $67,000 or less per year, people with disabilities and limited English-speaking individuals who need help doing their taxes.

The IRS-managed VITA and TCE services are operated by IRS partners and consist of volunteers who must pass tax law training that meets or exceeds IRS standards. Eligible taxpayers are encouraged to use the VITA Locator Tool online or call 800-906-9887 .

Watch out for red flags of tax preparers

There are some clear signs when something is amiss. Here are two to be on the lookout for.

Ghost preparers

This type of tax preparer will complete your tax return but will not sign it so they don't leave a footprint. For e-filing, they will refuse to digitally sign the return as the paid preparer. This could be a sign of potential fraud.

The IRS also says that ghost preparers may:

- Demand cash payments exclusively and do not offer receipts.

- Send direct refunds to their bank account instead of the taxpayer's account.

- Fabricate earnings to incorrectly make their clients eligible for tax credits or invent false deductions to secure larger refunds.

Absence of a legitimate PTIN

Each compensated tax preparer needs to possess a legitimate Preparer Tax Identification Number (PTIN) and should incorporate it whenever they sign any tax return prepared for another individual. However, merely having a valid PTIN may still fall short. As Bowman clarified, these numbers come with certain constraints. He stated in an emailed response, “Although tax preparers who complete returns for compensation must enroll with the Internal Revenue Service (IRS) and secure a Preparer Tax Identification Number (PTIN), this only fulfills their registration obligation. The IRS does not mandate any specific training or examinations.”

Bowman suggests that individuals investigate their prospective tax preparers using platforms such as the Better Business Bureau (BBB), Google, and various online review websites to learn about others' experiences. Regardless of whether they are an attorney, certified public accountant (CPA), or an IRS-licensed enrolled agent, you can obtain information regarding any disciplinary actions taken against them. An enrolled agent holds equivalent authority to attorneys and CPAs when representing clients facing administrative matters with the Internal Revenue Service (IRS).

That’s why you should obtain your preparer through verified channels, such as the official IRS directory .

Advice from tax professionals on selecting a preparer

Bowman also has several extra factors to consider when selecting someone to prepare your tax return.

- Steer clear of tax preparers who guarantee a bigger refund than others. This could be a warning sign that they may be engaging in unlawful practices to increase your refund, as mentioned by him.

- Steer clear of preparers who accept your statement about your Social Security number without verification or base their tax preparation on your most recent pay stub rather than an accurate W-2 form. As he noted, such practices are not just against IRS regulations; they also signal that the preparer could potentially engage in unethical behavior.

- A further indication of possible deceptive practices is when a tax preparer asks you to sign an empty tax return form or fails to include their signature along with their Personal Tax Identification Number (PTIN) on it.

Here are some IRS recommendations for selecting your tax preparer:

The IRS offers several tips That every taxpayer should watch for. Below are some key points:

- Talk about service charges at the beginning. Failing to do so might lead to unexpected additional costs. According to the IRS, it’s best to steer clear of preparers who charge based on a percentage of your refund.

- Although you may not consider yourself a tax expert, make sure to thoroughly examine the completed tax return as much as possible. Do not be afraid to inquire about anything that seems incorrect. Ensure that the bank details for the refund belong to you and not the person who prepared the taxes.

- The preparer you select should preferably be accessible throughout the year. You might have tax queries even after the filing season concludes.

- Get to know your preparers' qualifications and seek further information from them if something needs clarifying.

Individuals who prepare reports and engage in unethical behavior

If your tax preparer engages in any form of wrongdoing, it needs to be reported. Given that they might have acted similarly with other clients and could continue doing so in the future, there’s every reason not to stay silent about it. Fortunately, the IRS provides a straightforward method for lodging such complaints along with guidance on recognizing when reporting is necessary. file a complaint . To learn more, make sure not to miss our 2025 tax hub when dealing with anything related to taxes.

Initially released on March 17, 2025 at 9:54 a.m. Pacific Time.